COMMERCIAL SOLAR AND ENERGY STORAGE

Save Money for Your Business

Solar (especially when paired with battery) will help you fight constantly rising energy prices and manage your budgets.

With electricity being one of the largest expenses for most businesses, solar helps stabilize your bottom line. As your company continues to grow, it will inevitably consume more energy for lighting, HVAC, production, computing, and other business needs. Solar will help you fight constantly rising energy prices and manage your budgets.

Paired with federal tax incentives, special grant programs for qualified companies and depreciation benefits, we can help your business achieve energy independence while maximizing the return on your investment.

- Low maintenance.

- Improves Property Value.

- Greatly reduce your commercial electric bill.

- Sustainable.

- Profitable investment.

- 25-year manufacturer warranties.

- Qualifies for 30% Federal Tax Credit.

- Accelerated depreciation for commercial and farming operations.

Solar Makes Financial Sense

We make the cost of solar for your business or farm cash flow positive. Working with our parent company, Good Energy Solutions, our team can install a solar electric system that could actually cost LESS than what you are currently paying for your power and energy.

As the cost of conventional electricity continues to rise, a commercial solar array can help lock in what you pay for power every month. Once your system is paid off, you can expect your monthly electricity bills to drop dramatically.

Our company also recommends battery energy storage systems to companies that want to reduce peak demand by storing energy during off-peak hours and releasing it during peak hours. This process can save money on electricity bills.

Experienced Installers

Due to the acquisition of Laven Electric we are able to combine our commercial electrical installation expertise with the expertise of Good Energy Solutions in the solar and energy management sector. Good Energy Solutions has been installing solar panels in Kansas and Missouri since 2007. Solar and Energy Storage designers, installers, and sales professionals hold their certifications by the North American Board of Certified Energy Practitioners (NABCEP), indicating they are elites in the solar and energy storage industry. Good Energy Solutions and Laven Electric have accumulated hundreds of 5-star reviews on Google and across the web. We love working with businesses to find ways to save money, manage energy, and lower their carbon footprint on the environment.

Battery Backup and Energy Management Options

Batteries can help reduce your reliance on the grid during high-demand hours when energy rates are highest for Time of Use rate structures to allow your business to cut energy costs. Batteries can also reduce monthly utility bills by dumping their electrons into your facility during high power events during the day. The battery is then recharged during lower power usage hours, effectively reducing demand charges that the utilities add to your bill. This is called Peak Demand Shaving. Demand charges (based on instantaneous kilowatts of power) can be as expensive on some customer bills as the energy charges (based on kilowatt hours of energy), By combining on-site solar generation with battery storage, your business can strategically use solar power and stored energy to avoid drawing expensive electricity from the grid while also lowering its carbon footprint. Batteries improve energy stability and security by potentially keeping your business running when the grid goes down, if that is a design consideration.

TIME IS RUNNING OUT TO SAFE HARBOR FEDERAL INCENTIVES FOR SOLAR AND BATTERIES.

Commercial solar isn’t just good for the environment. It’s a smart financial move. With federal incentives available in 2026, installing a solar energy system can significantly reduce your operating costs, boost property value, and accelerate your return on investment.

Navigating the complex landscape of tax credits and depreciation benefits can be overwhelming. This guide breaks down the federal incentives that make going solar a powerful economic decision for U.S. businesses in 2026 and beyond.

Federal Solar Tax Credits: The Investment Tax Credit (ITC)

At the heart of federal solar incentives is the Investment Tax Credit (ITC), one of the most valuable financial benefits available to businesses that install solar.

What the ITC Means for Your Business

Under current federal policy, businesses that begin construction on a solar project in 2026 qualify for a 30% tax credit on the total cost of the system, including panels, inverters, wiring, and installation labor.

For example:

A $200,000 solar installation could generate a $60,000 federal tax credit.

This credit directly reduces your federal tax liability, a dollar-for-dollar savings.

FEOC Rules

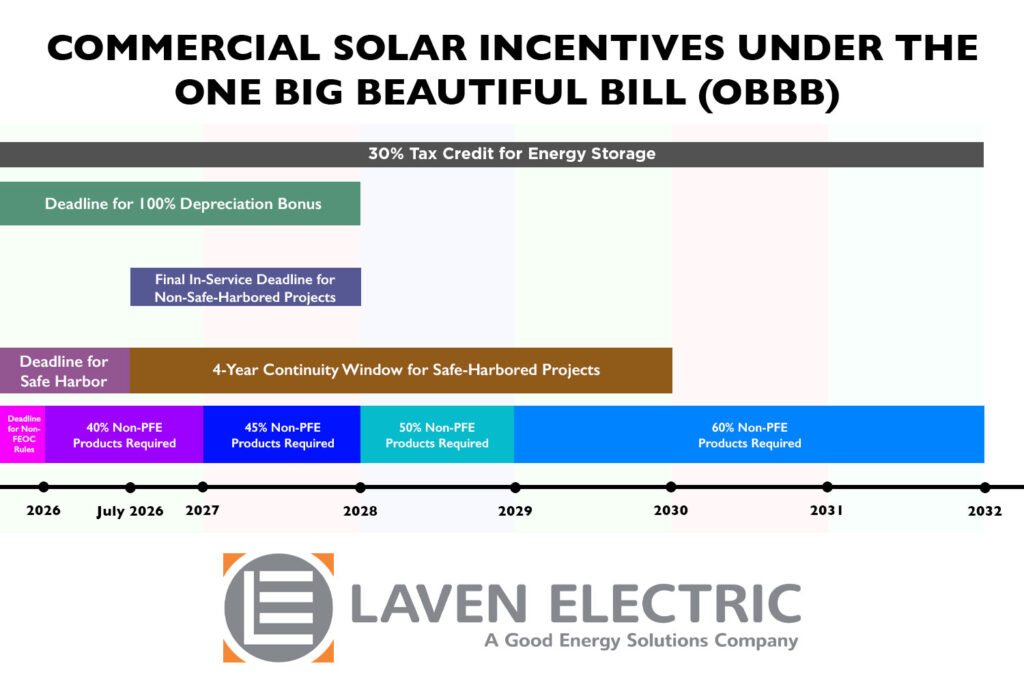

An additional layer to all this are the new Foreign Entities of Concern (FEOC) restrictions that were put in place by the OBBB. These new rules began on January 1st, 2026 and will impact any solar project not safe harbored at that time.

While the specifics around FEOC rules have not yet been released, FEOC will limit tax credit eligibility for solar projects based on the percentage of materials that come from certain countries. Projects that have significant “material assistance” from countries like China, Russian and North Korea will have limited access to the tax credits.

The IRS is anticipated to release rules on FEOC in 2026. Until then, our team is staying up to date on guidance to ensure your project receives the most tax credit and adders available. We’ll continue to provide updated information with you with as it becomes available.

Why Timing Matters Now More Than Ever

Under previous law, commercial solar projects could lock in a 30% federal tax credit for years to come. After new legislation passed in mid-2025, that window has sharply narrowed.

Here’s the bottom line:

30% Federal Commercial ITC still exists, but only for projects that meet accelerated deadlines.

Projects must begin construction by July 4, 2026 or be fully operational by Dec. 31, 2027 to qualify for the tax credit.

Projects that miss these deadlines won’t qualify for any federal solar ITC at all.

This compressed timeline makes prompt planning and execution critical if you want the full benefit.

What Counts as “Starting Construction”?

To protect your eligibility for the 30% ITC, you need to prove your project has “begun construction.” There are two primary ways to do this:

1. Physical Work of a Significant Nature

This method now applies to all larger commercial projects (typically above 1.5 MW). You must perform meaningful onsite or offsite construction activities, like racking installation or manufacturing key components, to establish eligibility.

2. 5% Safe-Harbor Rule (Smaller Projects)

Smaller systems (≤ 1.5 MW AC) can still use the traditional 5% cost method: if you incur at least 5% of your total project cost early in the project year, you can safe-harbor the credit.

Good to know: Once you start construction, you must either finish within four years or maintain continuous progress or you risk losing your federal ITC.

Bonus Incentives That Boost Your Solar Savings

Beyond the base 30% credit, there are additional ways to increase federal incentives:

Domestic Content Bonus: If your project includes a required percentage of U.S.-manufactured components, you may earn an extra 10% credit.

Energy Community Bonus: Projects in designated brownfields or former fossil fuel zones can also qualify for up to 10% more credit.

100% Bonus Depreciation: Commercial solar and standalone battery systems still qualify for 100% first-year depreciation, significantly improving cash flow and ROI.

These bonus adders can combine to push your total tax benefit well above 40% of system costs in certain cases.

REAP Grants for Rural Businesses

If you’re a rural small business or agricultural producer, the Rural Energy for America Program (REAP) offers competitive grants and loan guarantees that can cover up to 50% of your solar project cost.

REAP grants can be paired with federal tax credits like the ITC, driving your overall investment cost down, making solar not just affordable but highly profitable.

Standalone Battery Storage Is Now Eligible Too

Thanks to recent law changes, battery systems (≥ 3 kWh) qualify for the same federal tax incentives as solar, even if not paired with a PV array.

That means businesses investing in energy resilience and demand management can also capture a 30% tax credit on batteries and related labor.

Calculate Your Return on Investment

To understand the real financial impact of a solar project, consider:

Total Project Cost – Equipment, installation, and design

Energy Savings – Reduced utility bills over decades

Federal Tax Credits – ITC and potential bonus adders

Depreciation Benefits – MACRS write-offs over time

Seasoned solar professionals will perform a detailed cost-benefit analysis that shows your projected payback period, often 3–7 years, and lifetime savings over a system’s 25+ year lifespan.

Why Now Is the Time to Act

Federal incentives make 2026 a pivotal year for commercial solar. Businesses that begin construction this year lock in the full suite of federal tax benefits and position themselves for long-term energy savings.

Delaying your project could mean missing out on the best available financial incentives and leaving money on the table.

Commercial Solar FAQs

What commercial solar services does Laven Electric provide?

Laven Electric provides full-service commercial solar solutions, including system design, electrical infrastructure, service upgrades, installation support, and integration with existing electrical systems for businesses and institutions.

What types of commercial properties are a good fit for solar?

Commercial solar is a strong fit for office buildings, warehouses, manufacturing facilities, schools, healthcare facilities, municipalities, retail centers, and multi-tenant properties with sufficient roof space or available ground area.

Can solar be installed on an existing commercial building?

Yes. Most commercial solar projects are installed on existing buildings. Laven Electric evaluates your current electrical service, roof or site conditions, and load requirements to ensure the system is properly designed and safely integrated.

Will my business still have power if the grid goes down?

Standard grid-tied solar systems shut down during an outage for safety reasons. However, solar can be paired with battery storage or backup generation to provide limited or extended power during outages, depending on system design.

How long does a commercial solar project take?

Timelines vary based on system size, permitting, and utility coordination. Most commercial solar projects move from design through installation over several months, with construction typically completed in a matter of weeks once approvals are in place.

What financial benefits does commercial solar offer?

Commercial solar can significantly reduce electricity costs and provide long-term energy price stability. Many projects also qualify for federal tax incentives, depreciation benefits, and utility programs that improve return on investment.

Can solar be combined with energy storage or other electrical upgrades?

Yes. Commercial solar systems can be paired with battery storage, service upgrades, EV charging infrastructure, and energy management solutions to improve resilience and maximize energy savings.

How do I get started with a commercial solar project?

Getting started begins with a consultation and site evaluation. Laven Electric will review your energy usage, electrical infrastructure, and goals to determine whether commercial solar is a good fit and outline next steps.

Contact Us

“No mobile information will be shared with third parties/affiliates for marketing/promotional purposes. All the above categories exclude text messaging originator opt-in data and consent; this information will not be shared with any third parties.”

Hours

Monday – Friday

7:30 AM – 4:30 PM

Location

836 Spruce Street

Leavenworth, KS

Contact Info